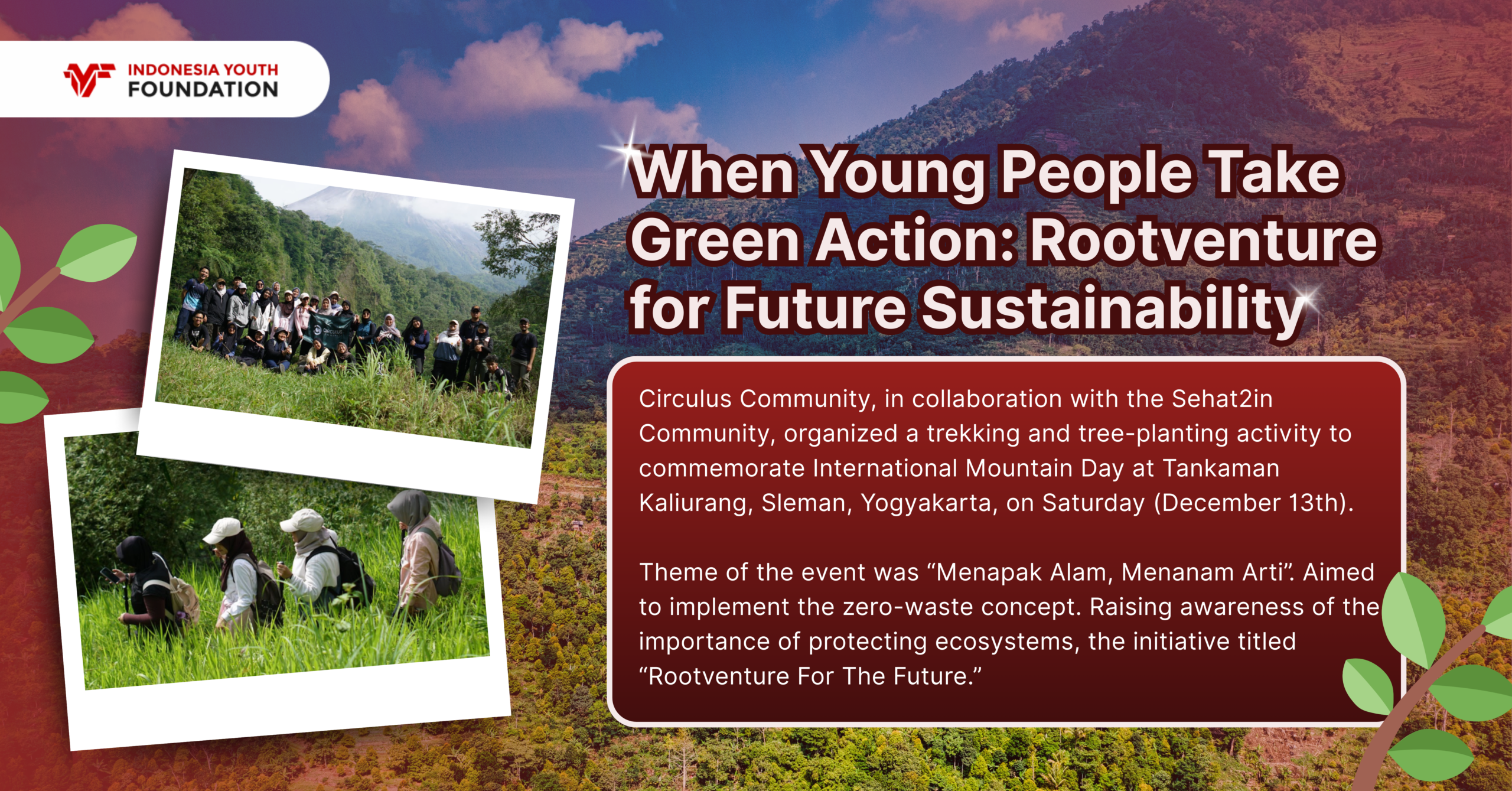

When Young People Take Green Action: Rootventure for Future Sustainability

Recession is certainly a terrifying monster within a national system. It arrives uninvited, bringing economic suffering and dragging thousands of people into the abyss of poverty. But do we really know who the true enemy is in the battle against a recession? Let’s take a closer look at the nature and sources of this monster and how we can prepare ourselves to overcome it. According to the International Monetary Fund, a recession occurs when a country’s GDP declines for two consecutive quarters. Economic hardship or recession can occur due to various factors such as financial crises, pandemics, political instability, or significant changes in global demand. So, why is a recession called a monster? How dangerous is this monster?

A recession is not just an economic problem; it is also a social problem. Thousands of people are almost certain to lose their jobs and livelihoods during a recession, leading to issues such as poverty and unemployment. Moreover, a recession also causes a contraction in consumption, which can ultimately create difficulties for companies in selling their products and services. This can lead to companies reducing their workforce or even going bankrupt. Therefore, cooperation between the government, companies, and society is necessary to address the negative impacts of this recession.

When a recession approaches like a destructive monster in its path, anyone would naturally worries. However, just like a security guard is always ready to fight an enemy, the Indonesian government must also be prepared to deal with this monster. In the battle against this monster, Tax Rates and Government Spending emerge as the government’s primary weapons. Like humans, the government must also manage its finances well. The activities involved in managing government finances through tax rates and government spending are called fiscal policies.

According to a senior American economist Pete Sessions, “Tax cuts can provide the necessary economic stimulus during a recession by increasing people’s purchasing power and promoting economic growth.” Data supporting this statement also demonstrates that countries with lower tax rates tend to experience lower unemployment rates during recessions. Reducing taxes can stimulate people’s purchasing power and boost national consumption and investment. Furthermore, strengthening the efficiency and effectiveness of Government Spending can help stimulate further economic growth and defeat the recession monster. However, as in any battle, the government must wield these two weapons in a balanced and careful manner to prevent larger fiscal problems.

After successfully defeating the big monster (recession), countries often face a small monster that comes afterward, which is inflation. Inflation is a general increase in prices in the economy, which can cause the value of a currency and people’s purchasing power to decline. Former US President Ronald Reagan stated, “Inflation is just as vicious as a thief, as frightening as an armed robber, and as deadly as a hitman.” Inflation, though not always perceived as a significant threat like a small monster, can cause substantial damage to the country’s economy if left unchecked. Therefore, the government must take immediate action to control this small monster before it becomes too big to handle. However, it is important not to focus too much on defeating the small monster, lest we forget to prevent the big monster from returning and attacking.

The government must establish suitable tax rates to stabilize prices and control inflation by reducing circulating money. However, the challenge is that excessively high tax rates can diminish people’s purchasing power, causing a recurrence of recession. Conversely, overly low tax rates can trigger an inflation surge, threatening the sustainability of the country’s economy. In addition to tax rates, the government must regulate the optimal level of government spending to support the economy without causing a soaring inflation rate, which can give birth to a new monster, hyperinflation.

Proportional and balanced tax rates are the key to controlling inflation and recession. High tax rates can reduce aggregate demand and suppress inflation like a small monster that is easily controlled. However, excessively low tax rates can increase aggregate demand and cause inflation to become significant and difficult to control. The government must analyze deeply for the right balance between high tax rates controlling inflation and preventing recession. The appropriate balance between tax rates and government spending is also crucial to ensure a stable and prosperous economy. By finding the right balance, the government can ensure economic stability, maintain people’s purchasing power, and prevent the emergence of small monsters as well as the return of big monsters to the national economy.

Writer: Fauzan Khairullah Umaternate

REFERENCES

- Fishlow, A., & Friedman, J. (1994). Tax evasion, inflation and stabilization. Journal of Development Economics, 43(1), 105-123.

- Alt, J., Preston, I., & Sibieta, L. (2010). The political economy of tax policy. Dimensions of tax design: The mirrlees review, 1204-77.

- bakeuda.agamkab.go.id

Check other opinion articles here. Would you like your opinion articles to be published on the IYF opinion articles page? Check this out! Don’t forget to follow our Instagram, Gyouth!